On May 4, the US Federal Reserve increased the target federal funds rate1 by 50 basis points as part of what the central bank said will be a series of rate increases to combat soaring inflation in the US. Some investors may worry that rising interest rates will decrease equity valuations and therefore lead to relatively poor equity market performance. However, history offers good news: Equity returns in the US have been positive on average following hikes in the fed funds rate.

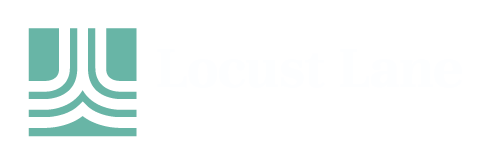

We study the relation between US equity returns, measured by the Fama/French Total US Market Research Index, and changes in the federal funds target rate from 1983 to 2021. Over this period of 468 months, rates increased in 70 months and decreased in 67 months. Exhibit 1 presents the average monthly returns of US equities in months when there is an increase, decrease, or no change in the target rate. On average, US equity market returns are reliably positive in months with increases in target rates.2 Moreover, the average stock market return in those months is similar to the average return in months with decreases or no changes in target rates.

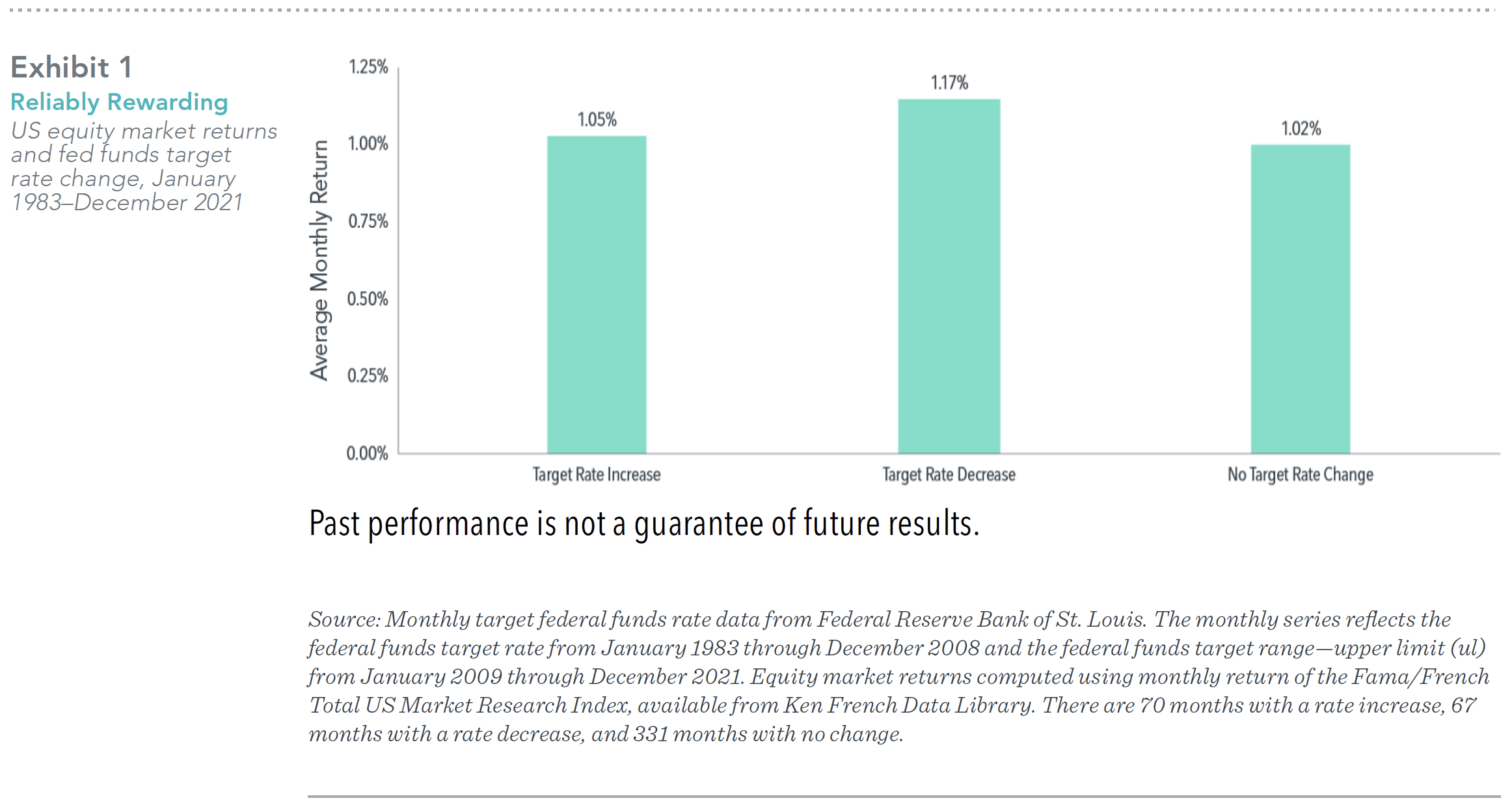

What about the months after rate hikes? This question may be of particular interest when the Fed is expected to increase the federal funds target rate multiple times. Exhibit 2 presents annualized US equity market returns over the one-, three-, and five-year periods following one or two consecutive monthly increases in the fed funds target rate, as well as following months with no increase. In reassuring news for investors concerned with the current environment of increasing rates, the US equity market has delivered strong longer-term performance on average regardless of activity at the Fed.

With a number of Federal Open Market Committee meetings remaining in 2022, the Fed’s signals and actions will continue to be closely watched by the market. As the Fed often signals its agenda in advance, we believe market participants are already incorporating this information into market prices. While it’s natural to wonder what the Fed’s actions mean for equity performance, our research indicates that US equity markets offer positive returns on average following rate hikes. Thus, reducing equity allocations in anticipation of, or in reaction to, fed funds rate increases is unlikely to lead to better investment outcomes. Instead, investors who maintain a broadly diversified portfolio and use information in market prices to systematically focus on higher expected returns may be better positioned for long-term investment success.

1. The federal funds rate is the interest rate at which depository institutions lend balances at the US Federal Reserve to other depository institutions overnight.

2. The Federal Open Market Committee (FOMC) holds eight regularly scheduled meetings per year and may not change the target rate at every meeting. The FOMC may also change the target rate multiple times within the same month; in such instances, we aggregate all changes by month.

DIMENSIONAL FUND ADVISORS AND TRIAD ADVISORS ARE NOT AFFILIATED.

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. It does not constitute investment advice, recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. It is the responsibility of any persons wishing to make a purchase to inform

themselves of and observe all applicable laws and regulations. Unauthorized copying, reproducing, duplicating, or transmitting of this document are strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd, Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

RISKS

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

Share this article:

Investor Risk Capacity Survey

Receive Your Risk Number

Take a 5-minute survey that covers topics such as portfolio size, top financial goals, and what you’re willing to risk for potential gains. We’ll use your responses to pinpoint your exact Risk Number to guide our decision-making process.