Key Takeways

- Value stocks have come roaring back, but the resulting performance lift has varied substantially across value managers.

- A continuous and accurate focus on value can put investors in the best position to capture value premiums when they appear.

- The relative performance of Dimensional strategies during the recent bounceback for value reflects a continued ability to deliver value when value delivers.

Value is an asset class, not an investment strategy. Identifying low relative price stocks is only one step toward designing and managing a value strategy; differences in managers’ implementation skill can lead to a wide range of outcomes experienced by value investors. Investors can evaluate these outcomes by assessing whether managers delivered what they said they would deliver. In the case of systematic value strategies, strong performance during periods when value stocks outperform signals an ability to capture value premiums when they appear.

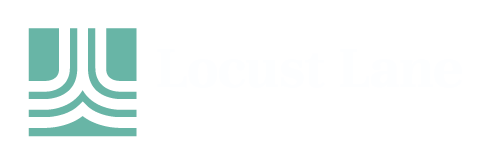

A Difference of Opinion

If 80% of success is just showing up, it follows that exposure to value stocks is a helpful start to capturing the value premium. However, even within a value category, exposure to low relative price stocks varies substantially across funds. For example, the 200-plus funds in the large cap value Morningstar category over the 10-year period ending March 31, 2022 had average price-to-book ratios ranging from 1.3 to over 6.6. That variation means not all funds in the category shared the same experience when the value premium appeared. In months when the Russell 1000 Value Index outperformed the Russell 1000 Growth Index, the average monthly net return for these funds ranged from 0.41% to 2.44%. A cursory inspection of the returns plotted against price-to-book ratios in Exhibit 1 reveals a negative relation for these months; all else equal, the greater the value exposure, the better the performance.

Testing Grounds

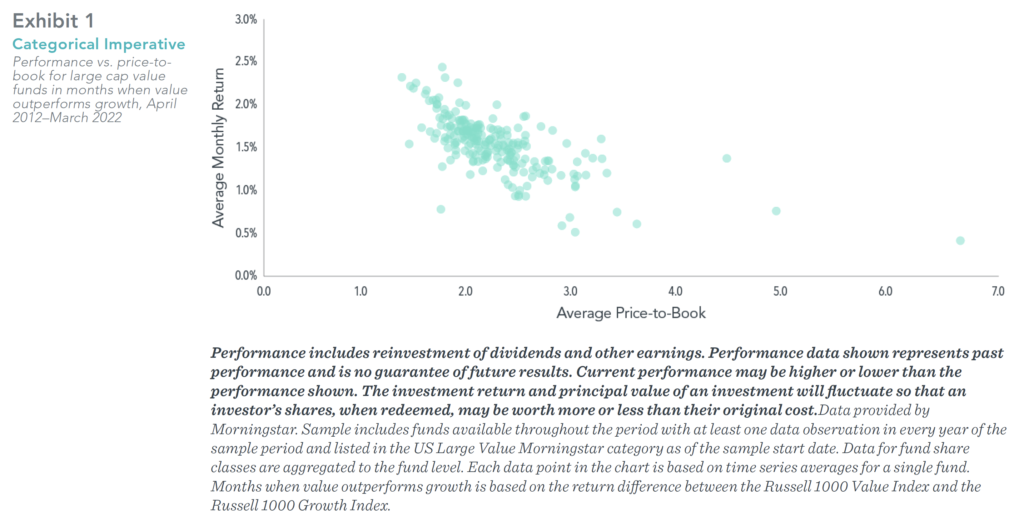

Dimensional’s value strategies seek to maintain a consistent focus on value stocks, day in and day out. We do this because we expect a positive value premium every day. While realized premiums can be negative, there is no evidence investors can reliably predict such occurrences.1 On the other hand, there is ample evidence the value premium can show up in bunches.2 A process that stays the course in its pursuit of value can therefore boost the odds of harvesting the premium when value stocks outperform.

A consistent focus on value stocks means that when the value premium materializes, Dimensional’s value strategies are in position to deliver the premium. Exhibit 2 shows the benefits of consistent focus on the value premium. The results show pervasive outperformance across market segments and geographical regions. When evaluated this way, Dimensional’s value funds delivered on their goal of capturing value premiums when they appeared.

Buyer Being Aware

Delivering on expectations helps investors pursue their goals by keeping the asset allocation decisions in their hands, not the manager’s. After all, uncertainty over what you’re going to get should be reserved for boxes of chocolates, not investment strategies.

1. Wei Dai, “Premium Timing with Valuation Ratios” (white paper, Dimensional Fund Advisors, March 2016).

2. “An Exceptional Value Premium,” Insights (blog), Dimensional Fund Advisors, October 2020.

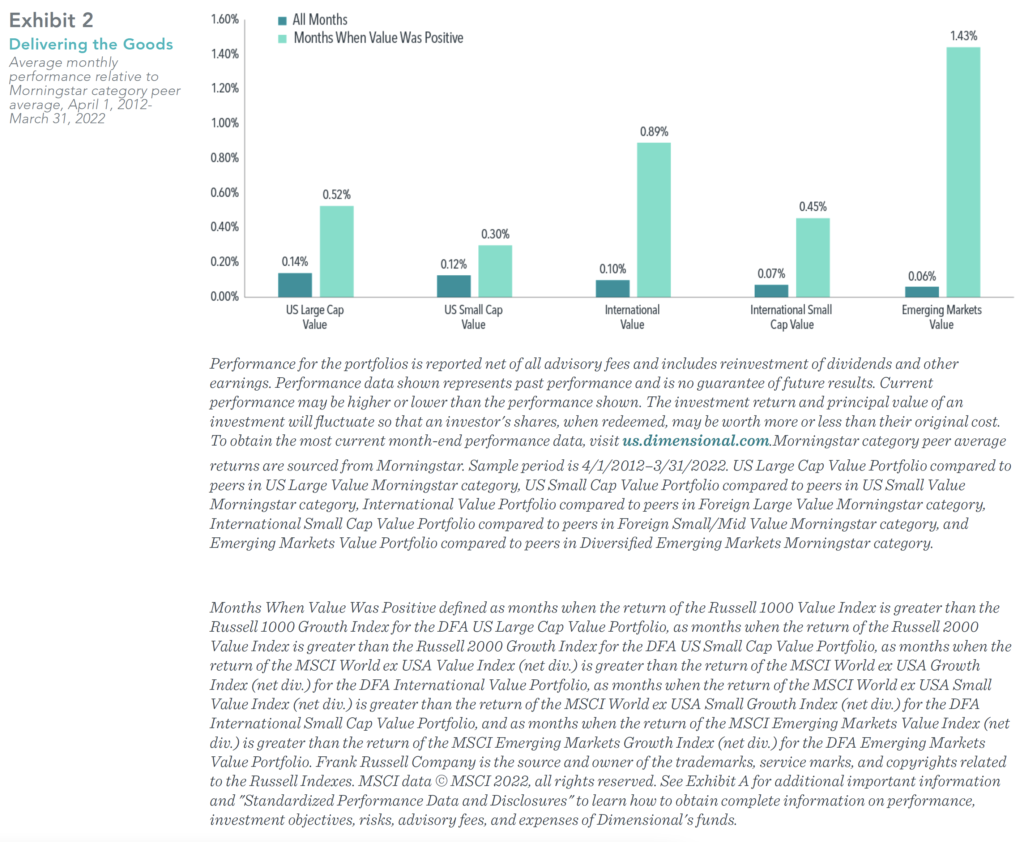

3. Performance information as of 3/31/22.

4. Fee and expense information as of the prospectus dated 02/28/22.

DIMENSIONAL FUND ADVISORS AND TRIAD ADVISORS ARE NOT AFFILIATED.

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. It does not constitute investment advice, recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. It is the responsibility of any persons wishing to make a purchase to inform

themselves of and observe all applicable laws and regulations. Unauthorized copying, reproducing, duplicating, or transmitting of this document are strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd, Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

RISKS

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

Share this article:

Investor Risk Capacity Survey

Receive Your Risk Number

Take a 5-minute survey that covers topics such as portfolio size, top financial goals, and what you’re willing to risk for potential gains. We’ll use your responses to pinpoint your exact Risk Number to guide our decision-making process.