TThe Magnificent 7’s performance in 2023 may leave some investors wondering how to spot the next Nvidia or Apple.1 Specifically, which technology disruptor will see its stock soaring next. Emerging technology–themed mutual funds and ETFs tout exposure to these opportunities.

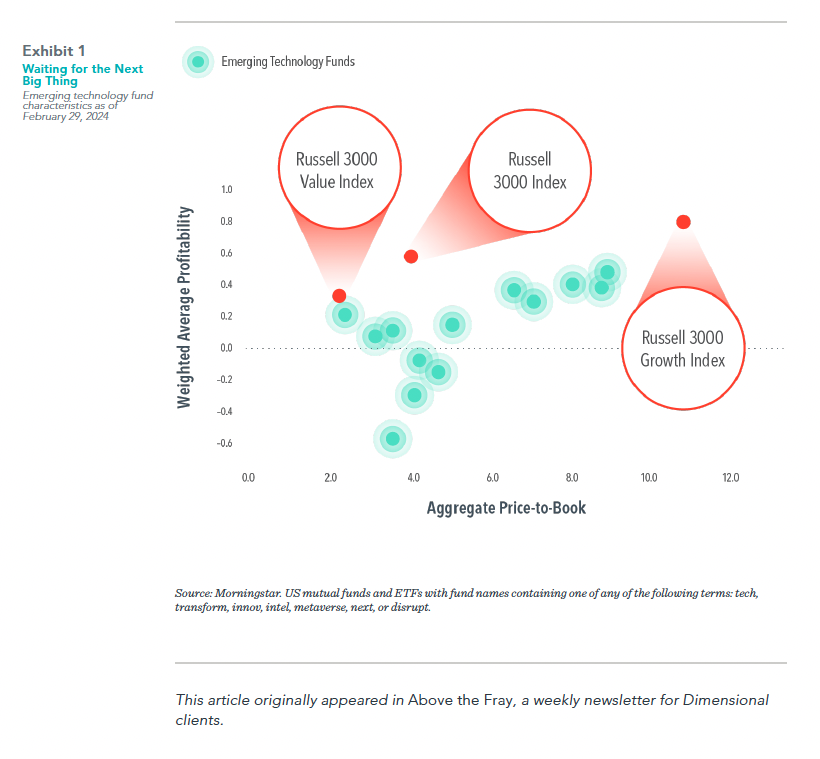

Of course, investors with broadly diversified portfolios likely already hold many of the companies they hope will lead the innovation charge. But investors wanting to amplify this exposure should be aware that emerging tech strategies tend to have characteristics that suggest low expected returns. Exhibit 1 illustrates price-to-book and profitability characteristics for 13 US mutual funds and ETFs identified based on key words in the fund name, such as “disrupt” or “transform.”2 More than half of them (nine out of 13) lean toward growth compared to the broad market, as measured by the Russell 3000 Index, and all are less profitable than the market. In fact, most (eight out of 13) have lower profitability than the value segment of the market.

Ultimately, trying to guess who will be technology’s Next Big Thing is a form of stock picking. Historically, that’s been a losing bet for most fund investors. It’s better to overweight stocks based on systematic differences in expected returns rather than on speculation.

1. Magnificent 7 include Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla. Named securities may be held in accounts managed by Dimensional.

2. See exhibit disclosure for full list of key words.

GLOSSARY

Profitability: A company’s operating income before depreciation and amortization minus interest expense scaled by book equity.

DIMENSIONAL FUND ADVISORS AND TRIAD ADVISORS ARE NOT AFFILIATED.

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. It does not constitute investment advice, recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. It is the responsibility of any persons wishing to make a purchase to inform

themselves of and observe all applicable laws and regulations. Unauthorized copying, reproducing, duplicating, or transmitting of this document are strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd, Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

RISKS

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

Share this article:

Investor Risk Capacity Survey

Receive Your Risk Number

Take a 5-minute survey that covers topics such as portfolio size, top financial goals, and what you’re willing to risk for potential gains. We’ll use your responses to pinpoint your exact Risk Number to guide our decision-making process.