With the benefit of hindsight, it’s hard to imagine a company not benefiting from the advent of e-commerce in the late 1990s. In fact, it’s easier to remember the blunders from that era. (Hello, pets.com!)

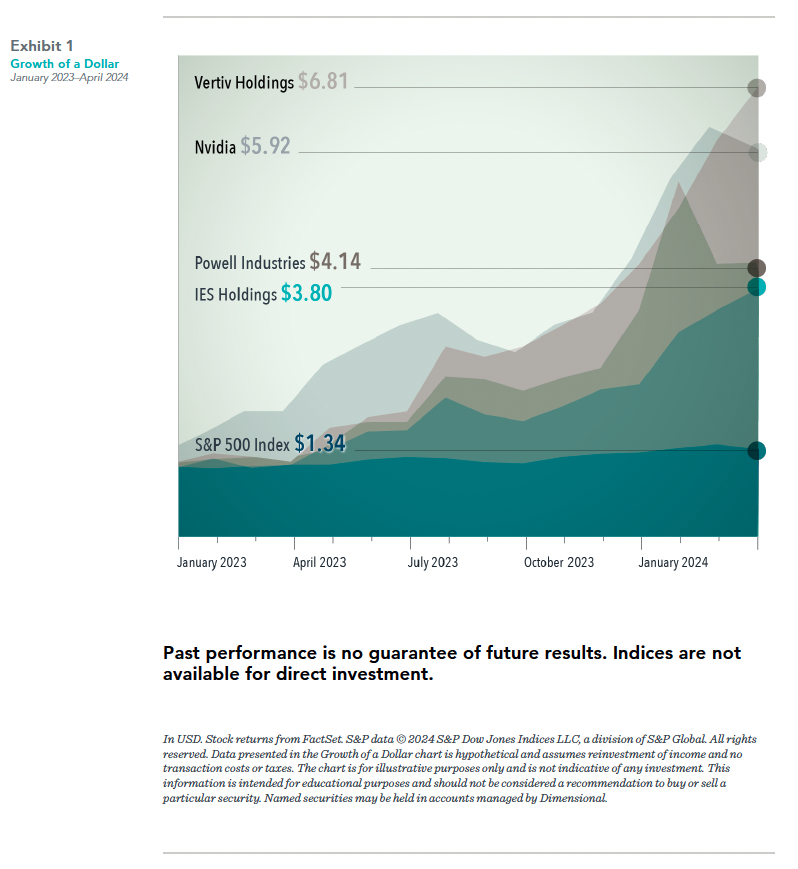

Breakthroughs in generative artificial intelligence seem poised to benefit a similarly wide gamut of businesses. Nvidia has been an early winner in the movement, and its stock has reflected this success. Since the start of 2023, Nvidia has returned nearly 600%. But the cascade effect of generative AI has already spread beyond just the household tech names.

Companies providing support to data centers are benefiting from the computational demands of AI tool development. For example, Vertiv Holdings provides liquid cooling products for these servers, which tend to run very hot. Two other companies, Powell Industries and IES Holdings, provide power and infrastructure to data centers. These three companies joined Nvidia in dwarfing the S&P 500 Index’s return since 2023.

The benefits of generative AI will likely spread beyond data centers. Many companies are adopting gen AI tools as implementation assistants to increase efficiency and scalability of their businesses. Eventually, we may reach a point where, like the internet, it’s hard to fathom a time before broad AI usage. That means investors don’t need a narrow sector fund or concentration in a handful of stocks to capture AI-fueled gains. A broadly diversified portfolio is likely to capture what many view as a sea change event in progress.

DIMENSIONAL FUND ADVISORS AND TRIAD ADVISORS ARE NOT AFFILIATED.

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. It does not constitute investment advice, recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. It is the responsibility of any persons wishing to make a purchase to inform

themselves of and observe all applicable laws and regulations. Unauthorized copying, reproducing, duplicating, or transmitting of this document are strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd, Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

RISKS

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

Share this article:

Investor Risk Capacity Survey

Receive Your Risk Number

Take a 5-minute survey that covers topics such as portfolio size, top financial goals, and what you’re willing to risk for potential gains. We’ll use your responses to pinpoint your exact Risk Number to guide our decision-making process.