One of the reasons why Fed watching is an unreliable input into investment decisions is because the Fed’s expected actions are already reflected in market prices. By the time the Fed executes rate changes, markets have already had time to form an expectation and may not need to react any further.

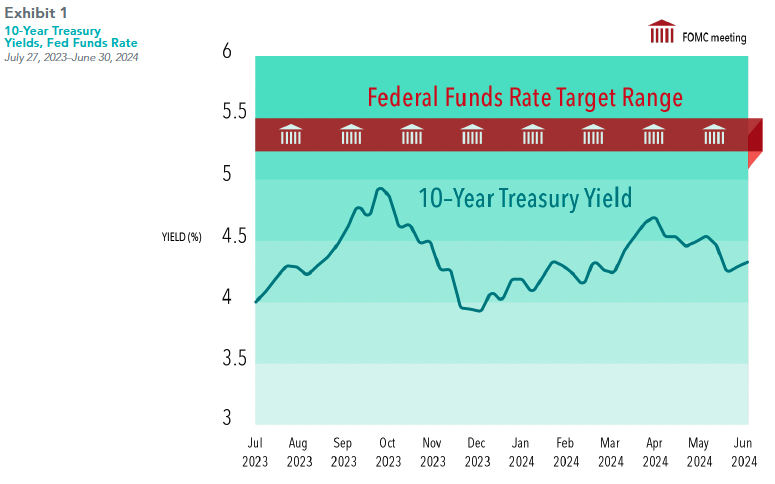

It’s also important to note there’s variation in market interest rates that is unrelated to changes in the Fed funds rate. For example, the Fed’s target range has remained constant over the past year. Meanwhile, the 10-year Treasury yield has fluctuated over this period, falling in the last quarter of 2023 before rising again this year.

This is a good example of why it’s hard for investors to draw actionable conclusions from Fed watching. The returns on your bond portfolio are likely not that closely correlated with the Fed funds rate. And unless you looked up future Treasury yields while out in your DeLorean, it’s unlikely you will be able to consistently outperform markets through interest rate predictions.

DIMENSIONAL FUND ADVISORS AND TRIAD ADVISORS ARE NOT AFFILIATED.

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. It does not constitute investment advice, recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. It is the responsibility of any persons wishing to make a purchase to inform

themselves of and observe all applicable laws and regulations. Unauthorized copying, reproducing, duplicating, or transmitting of this document are strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd, Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

RISKS

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

Share this article:

Investor Risk Capacity Survey

Receive Your Risk Number

Take a 5-minute survey that covers topics such as portfolio size, top financial goals, and what you’re willing to risk for potential gains. We’ll use your responses to pinpoint your exact Risk Number to guide our decision-making process.