Recent history reminds us that emerging markets can be volatile and can lag developed markets. However, emerging markets represent a meaningful piece of the global investment opportunity set. A disciplined but flexible approach, which Dimensional has used for decades, can provide the means to access the emerging markets opportunity set effectively.

RECENT PERFORMANCE IN PERSPECTIVE

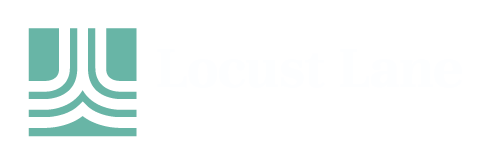

In recent years, the returns of emerging markets have lagged those of developed markets, with emerging markets underperforming US stocks by over 10 percentage points on an annualized basis over the past 10 years (see Exhibit 1). While recent returns have been disappointing, it is not uncommon to see periods when the reverse is true. For example, just looking back to the prior 10 years (2002–2011), emerging markets outperformed US stocks by more than 10 percentage points and other developed markets by 8 points on an annualized basis.

Over the entire 20-year period (2002–2021), emerging markets posted an annualized compound return of 9.7%, matching the return of US stocks and outperforming other developed markets.

A CLOSER LOOK AT EMERGING MARKETS COUNTRY PERFORMANCE

Investing across a broad set of emerging markets countries can help improve the reliability of investment outcomes. History shows that returns of individual emerging markets countries can be volatile and that dispersion across individual country returns can be wide. Substantial differences in returns can exist between the best-performing and worst-performing country. Exhibit 2 shows that these differences are often larger for emerging markets than for developed markets. Countries that rank among the worst performers in one year may rank among the best in subsequent periods. For example, Turkey had extreme underperformance in 2021 but has outperformed other emerging markets year-to-date through September 2022.

Concentrating in a few countries may expose investors to extreme outcomes. By holding a broadly diversified portfolio, investors are instead well-positioned to capture returns wherever they occur.

THE EVOLVING EMERGING MARKETS OPPORTUNITY SET

Emerging markets represent a meaningful opportunity set for investors. The size and composition of the investible universe in emerging markets have steadily evolved since the late 1980s, when most comprehensive data sets and benchmarks for emerging markets begin. At the beginning of 1990, emerging markets represented $63 billion and by the end of 2021, over $10 trillion, a staggering increase of well over a hundredfold. In the same period, developed markets grew by less than 10 times their value. Much of this increase can be attributed to the changing composition of emerging markets, as China, India, Korea, and Taiwan became the largest emerging markets. Over the years, major geopolitical, economic, and demographic changes have contributed to shifting weights for individual countries and companies within emerging markets, but in aggregate they have continued to grow.

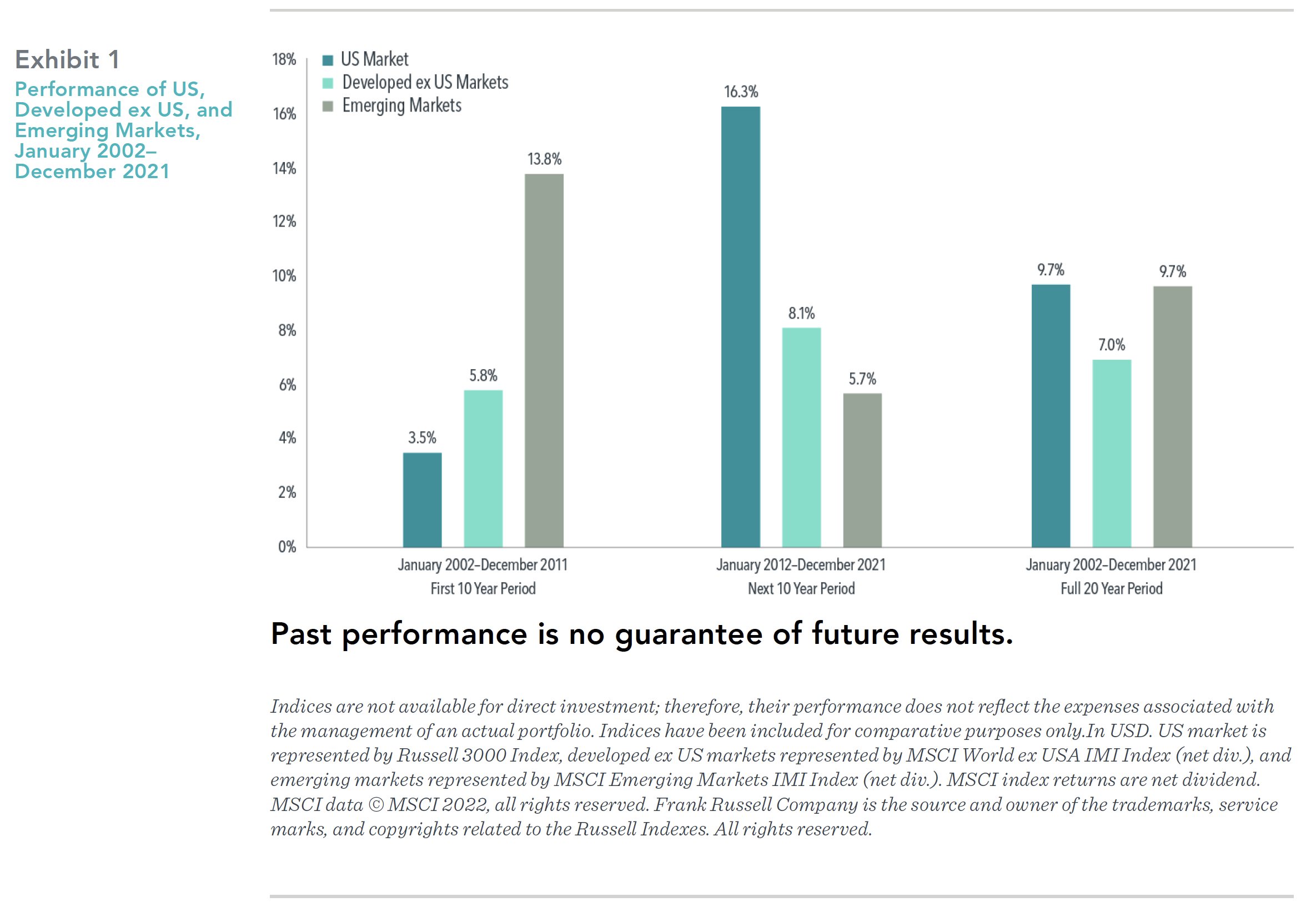

As of the end of 2021, the total free-float adjusted market capitalization of Dimensional’s emerging markets universe was $10.5 trillion and included 24 countries and over 7,000 securities. As shown in Panel A of Exhibit 3, emerging markets represented 12.7% of global markets’ free-float adjusted market capitalization. Measured by gross domestic product (GDP), emerging markets’ share increases to 38.3% (Panel B), reflecting the fact that emerging markets typically have smaller market capitalizations compared to GDP than most developed markets. Regardless of the metric, emerging markets represent a significant component of global markets.

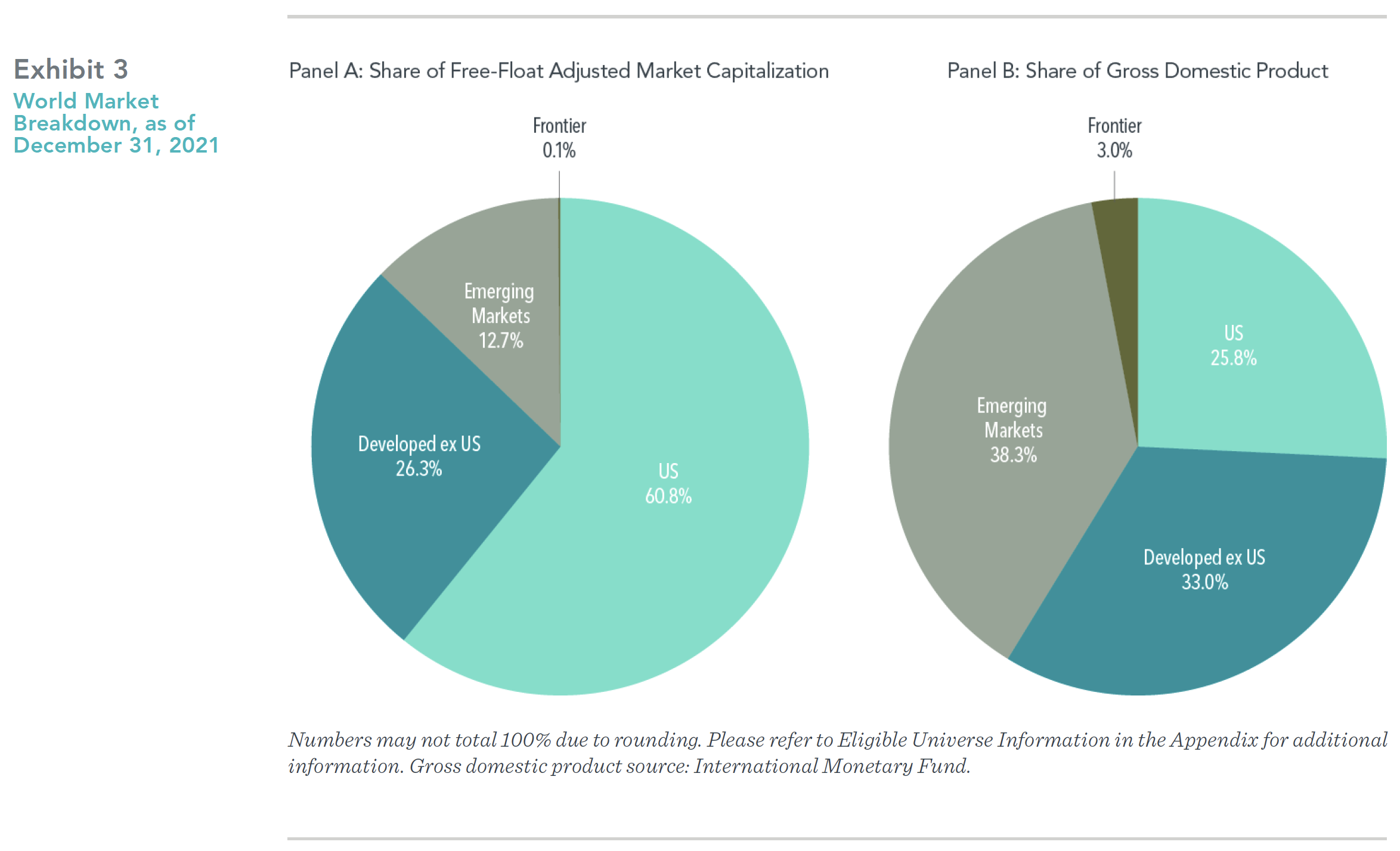

As shown in Exhibit 4, Panel A, the five largest countries in terms of market capitalization comprised approximately three-quarters of emerging markets at the end of 2021. Much attention has been paid to the growth of China over the past decade, which represented 28% of the emerging markets universe at the beginning of 2022. China’s growing share has been driven primarily by new equity issuance and new avenues for foreign investors to gain exposure to Chinese companies, including securities listed on the local Shanghai and Shenzhen stock exchanges through Hong Kong Stock Connect programs.

China’s weight in the emerging markets has prompted many questions from investors on issues ranging from benchmarking to geopolitical risk. While these issues are complex, it can be helpful to consider the weight of China and other individual emerging markets from a global perspective. Panel B of Exhibit 4 shows the weights of the top five countries in the global universe. Compared to its 28% weight in the emerging markets universe, China’s weight was just 3.5% in the global market, making it the fourth-largest country after the US, Japan, and the UK.

In addition to changes in size and country composition, emerging markets have undergone important improvements in their market mechanisms and microstructures over the past few decades. Many have broadly adopted international accounting and reporting practices. Our analysis suggests more than 90% of the firms in most emerging markets now report their annual financial statements according to International Financial Reporting Standards (IFRS) or US Generally Accepted Accounting Practices (GAAP). In countries like China, India, and Taiwan, the national standards have substantially converged toward IFRS. This has helped improve the reliability and transparency of financial data in emerging markets. Over time, emerging markets have also generally become more open to foreign investors due to reduced constraints on capital mobility. Evidence of these developments includes fewer instances of market closings, capital lockups, and trading suspensions of individual stocks in many markets.

However, navigating geopolitical events and potential market disruptions is still important when investing in emerging markets. Russia’s invasion of Ukraine in 2022 provides a stark example. The US and other Western governments issued sweeping new sanctions directed at Russia in response to the invasion. Dimensional had previously reduced the weight of Russia in our emerging markets and global equity portfolios after sanctions were imposed in 2014 following the annexation of Crimea. In January 2022, we halted further purchases of Russian stocks, and in March we removed Russia from our list of approved markets for investment. We believe that the most effective way to mitigate the risk of these types of unexpected events is through broad diversification and a flexible investment process.

IMPLEMENTATION MATTERS

Investing in emerging markets brings unique challenges, and since Dimensional first started investing in emerging markets almost 30 years ago, we have employed a flexible approach to meet those challenges. Flexibility can be critical in determining which markets and stocks are eligible, which security lines to buy when multiple share classes trade for the same stock, and when and how to trade them while avoiding unnecessary and costly index constraints.

By considering a combination of qualitative and quantitative criteria to determine which countries, exchanges, and securities are eligible, we have implemented changes in our eligible investment universe over time. Those considerations include the costs and frictions associated with accessing these markets. We apply certain minimum criteria in areas like market liquidity, regulation at the exchange level, listing requirements, and accounting standards. The addition of countries that meet our eligibility criteria helps improve diversification in our strategies that invest in emerging markets.

Once a market is eligible for investment, investors often have the option of trading more than one line of shares for the same emerging markets company. Thailand, for example, imposes restrictions on foreign ownership that may result in local and foreign shares trading for the same stock at different prices and volumes. Our approach is dynamic. Portfolio Managers decide which line to trade based on considerations such as prices, costs, liquidity, market regulation, and sometimes taxes, all of which can fluctuate from day to day. This approach contrasts with a more static approach of tracking the specific securities held by an index.

Flexibility in execution can help lower costs in our portfolios and thereby improve returns to investors, particularly in emerging markets, where trading costs can be higher than in developed markets. Dimensional uses a flexible trading approach every day that seeks to participate in available market liquidity and avoid the costs of seeking immediacy in trading execution. Our trading philosophy is consistent across stocks and markets. However, we conduct rigorous research on how to price, size, time, and route our orders across different market microstructures and tailor our approach appropriately. We believe a tailored approach is particularly important in emerging markets, where market microstructures tend to be less uniform than in developed markets.

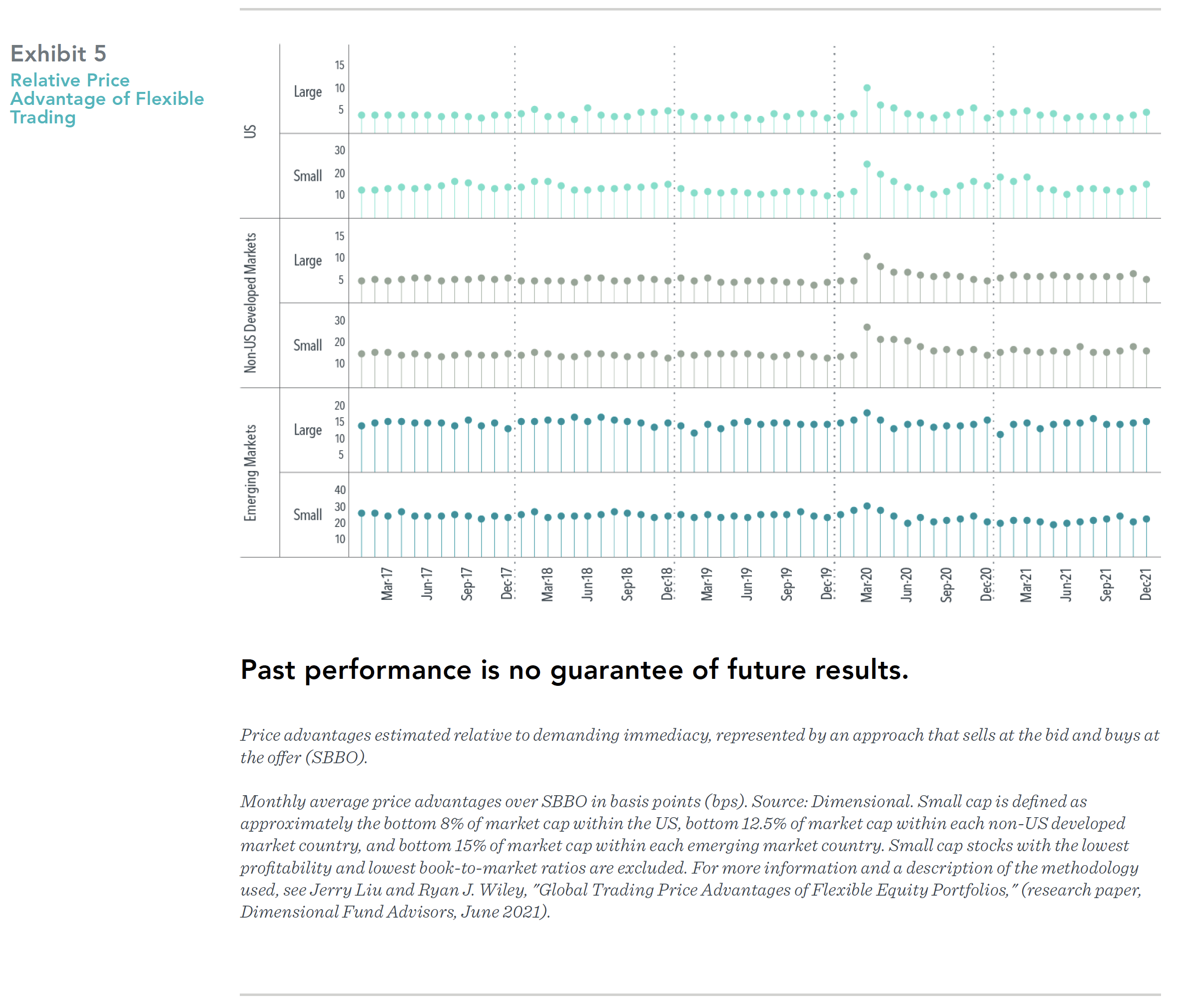

Exhibit 5 illustrates the estimated price advantage of Dimensional’s flexible trading approach compared to one that seeks immediacy. We compare the price advantage across regions and between large capitalization and small capitalization stocks. The data suggest that the benefits of flexible trading are positive in all categories and time periods shown, but even more beneficial in areas with higher potential trading costs, like smaller capitalization stocks and emerging markets.

NAVIGATING THE OPPORTUNITIES

Emerging markets represent a meaningful opportunity set within global markets. They continue to evolve in their structures, market mechanisms, and accessibility. Investors in emerging markets can benefit from a long-term perspective as well as expertise and flexibility in navigating these rapidly changing, heterogenous markets.

Dimensional offers investors broadly diversified exposure to emerging markets equities along with the systematic pursuit of higher expected returns. Through our decades of experience, we have built robust, systematic, and scalable processes for navigating these markets. Our expertise enables us to pursue opportunities to improve performance and reduce costs every day.

DIMENSIONAL FUND ADVISORS AND TRIAD ADVISORS ARE NOT AFFILIATED.

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. It does not constitute investment advice, recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. It is the responsibility of any persons wishing to make a purchase to inform

themselves of and observe all applicable laws and regulations. Unauthorized copying, reproducing, duplicating, or transmitting of this document are strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd, Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

RISKS

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

Share this article:

Investor Risk Capacity Survey

Receive Your Risk Number

Take a 5-minute survey that covers topics such as portfolio size, top financial goals, and what you’re willing to risk for potential gains. We’ll use your responses to pinpoint your exact Risk Number to guide our decision-making process.