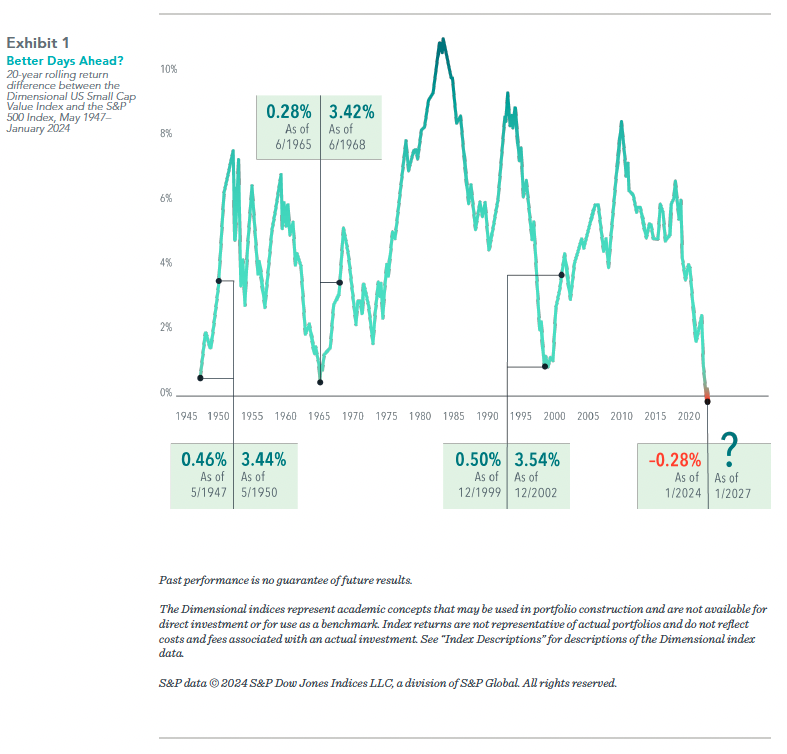

The 20-year relative return of US small cap value stocks versus the S&P 500 Index dipped negative recently for the first time in US stock market history. Two decades is a long time for an expected premium not to show up. Outliers on the negative side are never pleasant, but we can look to other previous outliers for some positive encouragement.

Many in the industry will recall the disappointing stretch at the end of the 1990s when US small cap value’s trailing 20-year return was statistically indistinguishable from the S&P 500’s. Less familiar might be the periods in 1947 and 1965 when the trailing 20-year premium was similarly flat. In all three cases, small value staged a rapid turnaround. We can see this by measuring each of the trailing 20-year return spreads again three years later. For example, we compare the observation on December 31, 1999, with the trailing 20-year return difference as of December 31, 2002. In all three previous cases, small cap value’s advantage jumped to more than three percentage points annualized.1

No one can say if we’ll get a similar turnaround this time. But history suggests giving up on small cap value after its worst stretches would have been a mistake. Past performance doesn’t upend the logic of expecting a higher return for stocks with low prices relative to their book equity. And, for any remaining skeptics, it’s worth noting that small value’s struggles in the US have not been shared by developed ex US or emerging markets, where small cap value stocks have outperformed their large cap counterparts by 2.7%1 and 4.0%2, respectively, over the past 20 years.

1. Based on the Dimensional International Small Cap Value Index (net div., USD) vs. the MSCI World ex USA Index (net div., USD) over the 20 years ending 1/31/2024. MSCI data © MSCI 2024, all rights reserved.

2. Based on the Dimensional Emerging Markets Small Value Index (net div., USD) vs. the MSCI Emerging Markets Index (net div., USD) over the 20 years ending 1/31/2024. MSCI data © MSCI 2024, all rights reserved.

DIMENSIONAL FUND ADVISORS AND TRIAD ADVISORS ARE NOT AFFILIATED.

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. It does not constitute investment advice, recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. It is the responsibility of any persons wishing to make a purchase to inform

themselves of and observe all applicable laws and regulations. Unauthorized copying, reproducing, duplicating, or transmitting of this document are strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd, Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

RISKS

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

Share this article:

Investor Risk Capacity Survey

Receive Your Risk Number

Take a 5-minute survey that covers topics such as portfolio size, top financial goals, and what you’re willing to risk for potential gains. We’ll use your responses to pinpoint your exact Risk Number to guide our decision-making process.